Copyright © Gerhard Richter 2014.

[](#)[](#)

Column: Financial

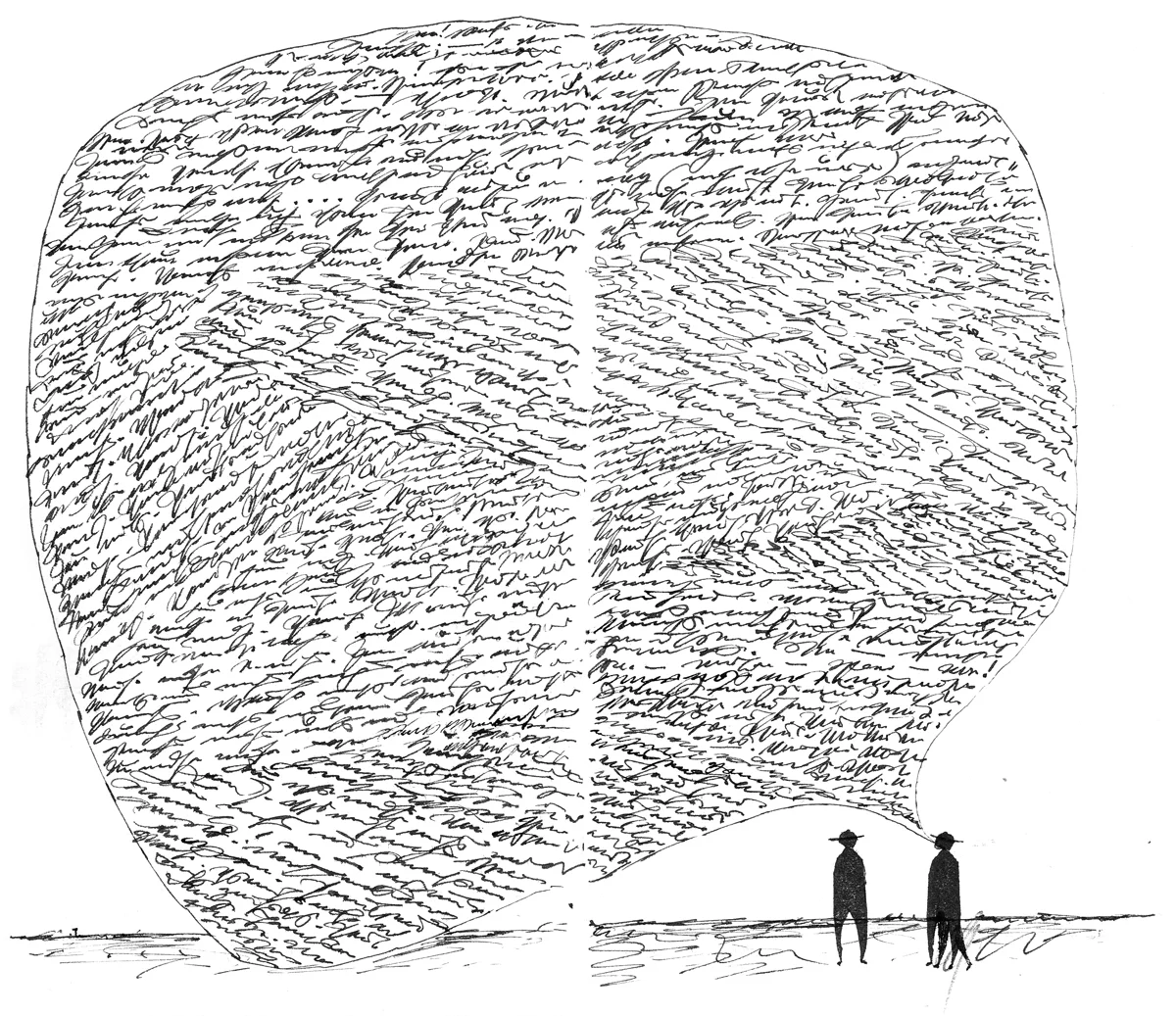

Money for Nothing

In 1931, one man saw the sudden end of all of civilization coming through economic collapse due to predatory lending, dangerous speculation, and greed. Montagu Norman was the Governor of the Bank of England, and England was the most powerful nation in the world at the time. He knew the stock market crash in the Americas, on Black Tuesday two years before, was just the beginning and there was no way to keep his country’s economy tied to the value of gold. He did what any sane man in his position would do. He collapsed in a heap of spasms, fear, and despair.

While Norman was on mandatory medical leave somewhere in Canada, the Bank of England did the one thing that Norman believed would destroy all of modern society: they left the gold standard. This made the printed money and coin worth only what the men in charge said it was worth.

If you took all the gold that has ever been mined, and you melted it into a cube, each side would be about 70 feet wide and 70 feet tall. That’s just not enough for the world to share.

In 1933, Franklin Roosevelt’s best economic advisors told him that gold is what kept the world working. They told him that there is no way in hell he should leave the gold standard, but instead of listening to them, he listened to a man who helped him cut some trees off his property, a man who wrote a book about dairy farms and how to get more eggs per chicken. This is a fact. That man’s name was George Warren, and Warren, being a fan of American economist Irving Fisher’s Compensated Dollar Plan—an alternative to the gold standard that stabilized the U.S. price level by devaluing and revaluing the dollar against the gold price—sold the idea to the President. When FDR told his staff of his decision many resigned, and others, like Montagu Norman, had nervous breakdowns.

Somehow the world survived, and in other countries people lived, died, and killed for printed money with questionable and ever-changing value. In 1971, Nixon took us a step further into this game of pretend with his “Nixon Shock” economic policies; the most notable unilaterally canceled the direct convertibility of U.S. dollars into gold. The days of bank accounts having a relationship with some poor asshole digging a shiny rock out of the ground were over.

Only 40 years and some change later we have the richest people in the history of mankind living right here. Bill Gates, for example, is worth about 80 billion dollars. How much is a billion dollars? This is a billion dollars: if you made 45,000 dollars a year it would take over 22,000 years to make a billion dollars; one billion minutes ago, according to the King James Bible, Jesus was alive; if you started right now and counted to a billion you’d be done in 2044. Now multiply that by 80.

If Bill took 50 billion of his dollars and did absolutely nothing with it other than put it in a bank that earned only 1 percent interest annually he would get a return of 500 million dollars for doing nothing except existing.

A penny saved is a penny earned, except today a penny costs the government 1.8 cents to make. A nickel costs 9.4 cents, but we make up for it with the dollar. It only costs 5.4 cents to make. The other 94.6 cents of its worth comes from playing pretend. When the stock market loses money it’s not like dollar bills suddenly disappear and when people accrue interest while having their money in the bank the coins don’t suddenly multiply. Most of our money is bits and bytes on a computer.

So, how much do you earn for an hour of your life?